Articles

Telematics – Connecting present through future!

The worldwide market for trucks industry is widely divided into two sectors:

• The First: Europe, North America, Japan & other industrialized East Asian nations

• The Second: BRIC countries & other emerging markets which are highly cost conscious and experiencing faster growth.

The developed markets have always been characterised by high level of environmental regulations and increasing demand for sophisticated technological improvements.

However, with the growing competition in emerging markets, the increasing demand for quality, features & services is now playing a pivotal role in intensifying industry dynamics. The customer demands are driving the shift from merely being low-cost solutions towards higher value, heavier trucks, aftermarket sales & latest innovations.

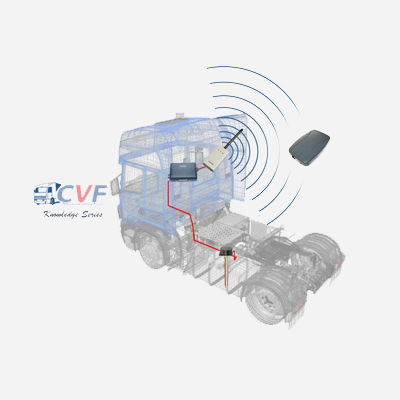

For the global truck industry, the latest growing trend in the segment of Innovative products is “Introduction of Telematics-enabled services”.

Globally, telematics technology is expected to become a standard automotive equipment by 2020.

Till now, the Indian telematics market has grown at a steady pace owing to factors like early adoption, upgradation of infrastructure and government regulations. After 2010, companies like Ashok Leyland, Mahindra & Mahindra and TATA have ventured into the telematics business. But, in the coming years, with the increase in awareness level, the growth of Telematics industry is a necessity. It has to happen.

In India, Heavy commercial vehicles (HCVs) have accounted for majority of the market share till now. However, with the increasing need for fleet management, Medium Commercial vehicles (MCVs) are also expected to register significant growth in telematics market over the coming years.

India’s Commercial Vehicles Telematics Market will exhibit rapid growth in the coming years. Initiatives like Toyota’s “Toyota Connect” for cars, “Tata SkoolMan” for school buses, “Tata FleetMan”, Eicher Drive Telematics, JCB’s “Livelink” and Mahindra & Mahindra’s “Digisense” from the major CV players of India prove that our market is placed in the right direction for growth in the Telematics segment.

The vehicle OEMs and telematics suppliers are upbeat about the increasing demand as awareness is on the rise with government involvement on passenger safety. With policy initiatives by central and local government, a prerequisite of 400,000 new buses is required by 2017. Such Initiatives, rising fuel prices and minimal profit margins in transportation industry are forcing the fleet operators to gain an edge through adoption of features such as vehicle tracking, route calculation, checks on fuel pilferage and other telematics capabilities.

As per the experts, the Indian Vehicle Tracking Market is set to double in size by 2017 and the India Commercial Vehicles Telematics Market installed base is projected to reach 1.4 million by 2022.

With factors such as increasing awareness level, potential market & policy initiatives, market is today in the right direction for growth in all segments. OEMs are creating new products and in parallel with market consolidation through M&A taking place, the foundation for Telematics industry is strengthening.

Join us at India’s leading Commercial Vehicle platform: Commercial Vehicle Forum 2016 (http://cvforum.in/) on 24th November 2016 at The Westin - Chennai where more of such trends will be discussed by industry experts.